In the world of cryptocurrency, building a well-diversified crypto portfolio is key to managing risk and maximising returns. With thousands of crypto assets to choose from, it can be challenging to decide which ones to include in your portfolio. To simplify this process, we’ve compiled a list of model crypto portfolios that cater to different investment strategies and risk appetites.

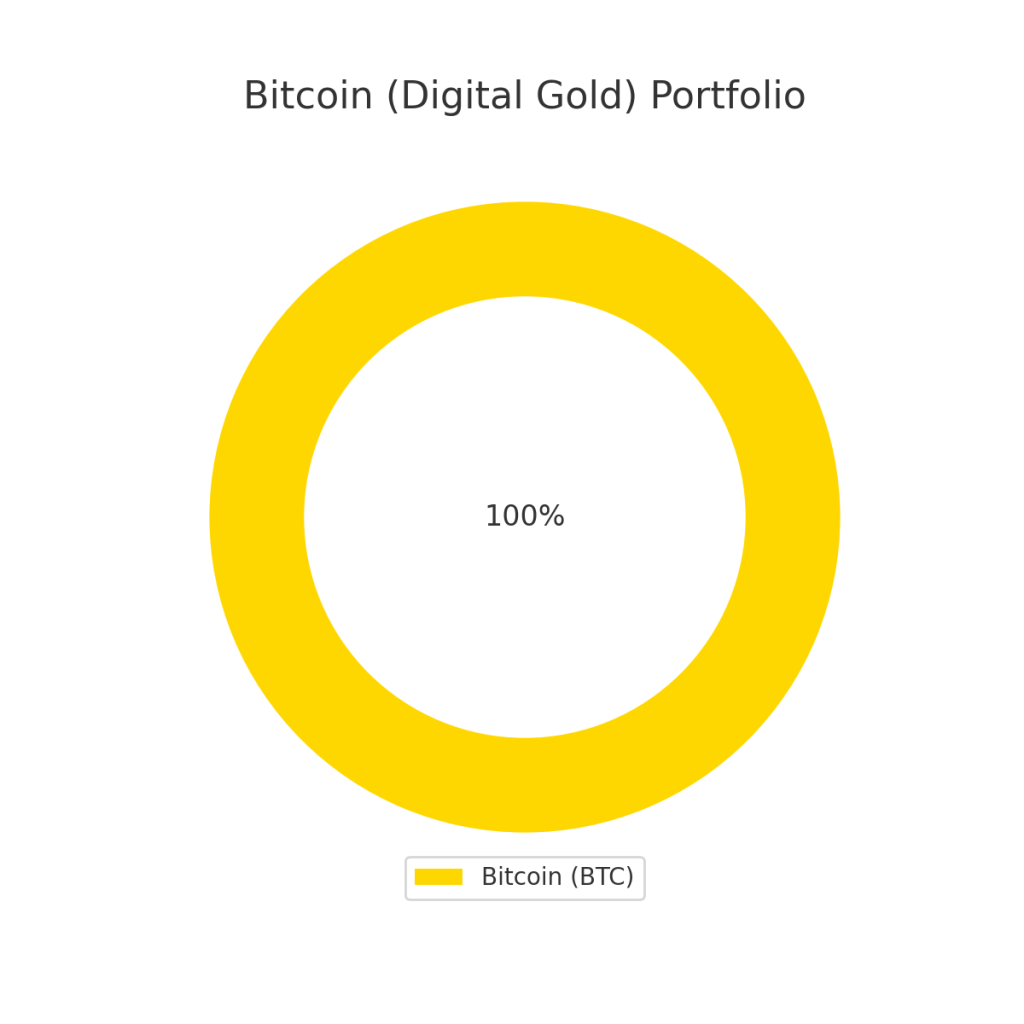

Bitcoin (Digital Gold)

The first model Crypto portfolio is for those who believe in the long-term value of Bitcoin and want to focus their investment on this digital asset which is compared are the digital gold. It includes only one token:

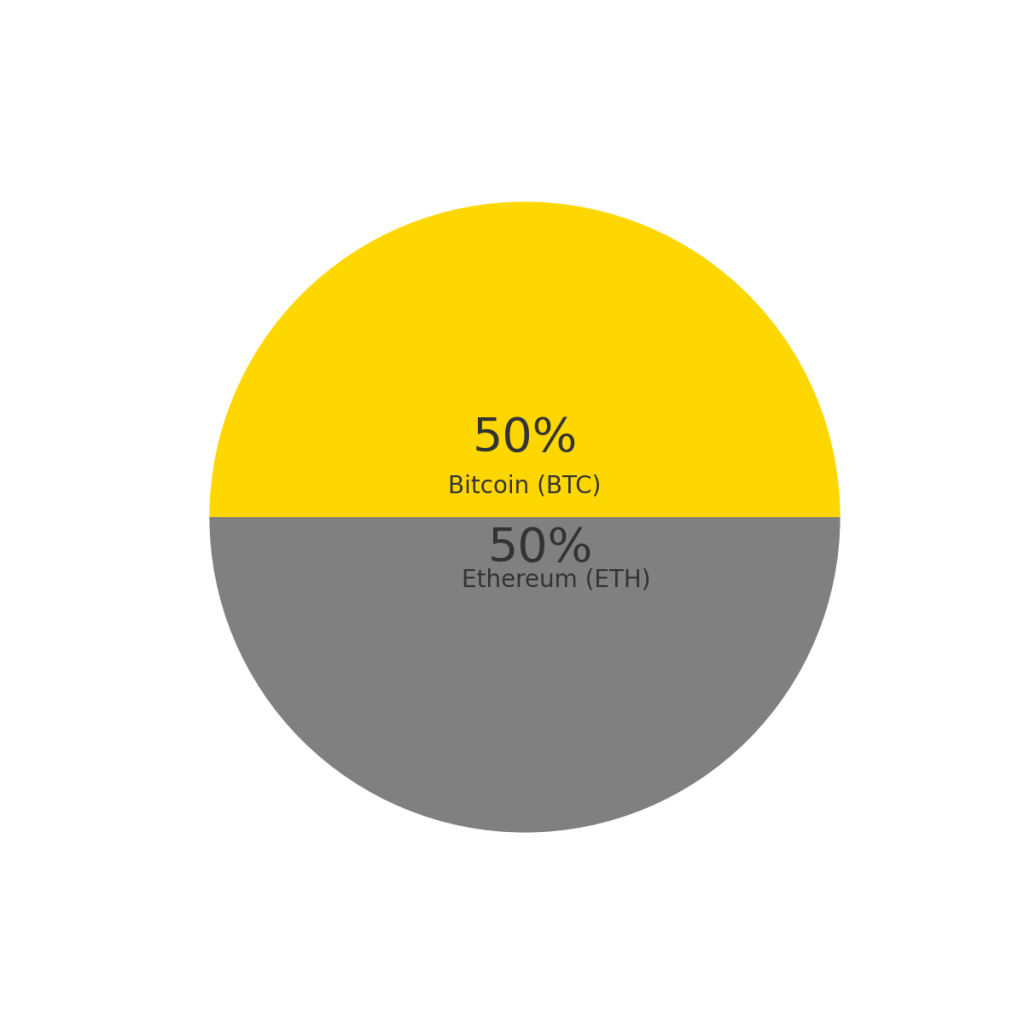

The Big 2 (Gold and Silver)

This model crypto portfolio example is perfect for those who prefer to stick with the most established and widely recognised cryptocurrencies Bitcoin and Ethereum. It includes:

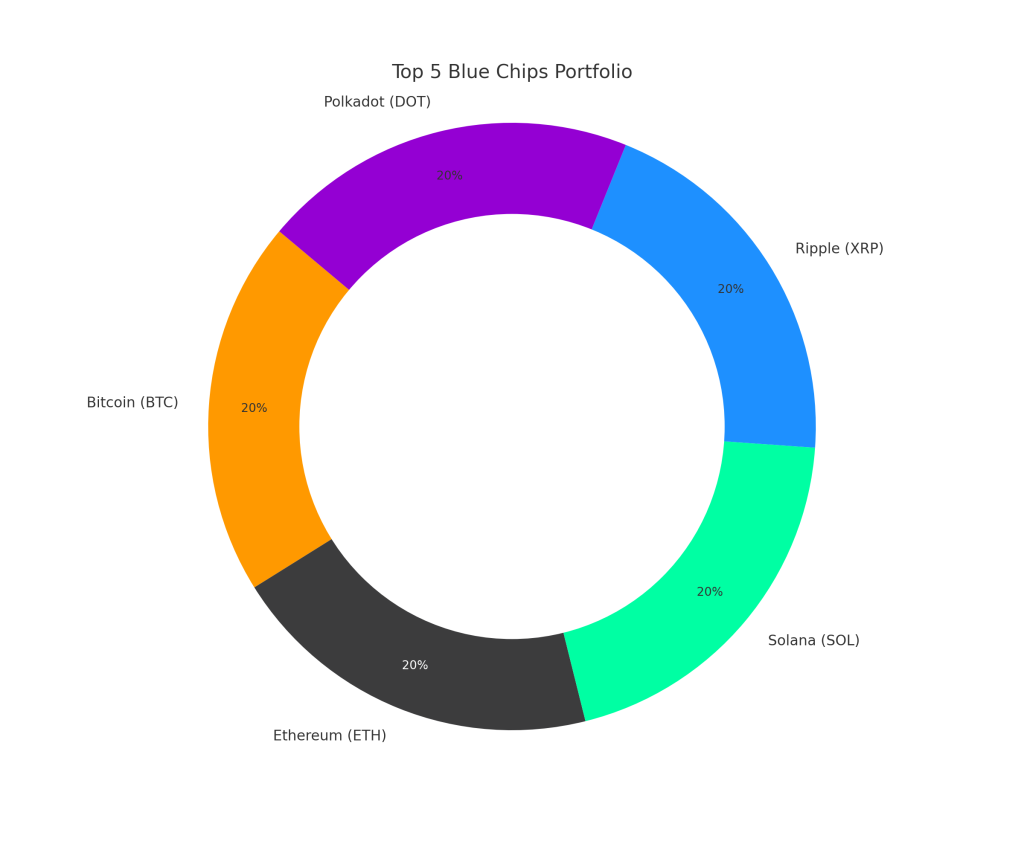

Top 5 Blue Chips

This portfolio is for those who want to invest in cryptocurrencies with large market capitalisations and established track records. It includes the top 5 crypto blue chip tokens:

Top 10 Crypto Tokens

This portfolio is designed for investors who want broad exposure to the top-performing cryptocurrencies. It includes:

| Bitcoin (BTC) | Ethereum (ETH) | Binance (BNB) | Polygon (MATIC) | Solana (SOL) | Avalanche (AVAX) | Litecoin (LTC) | Polkadot (DOT) | Ripple (XRP) | Cosmos (ATOM) |

|---|

Web 3.0 Gems

This model crypto portfolio is designed for investors who believe in the potential of Web 3.0 and want to invest in projects that are leading the way in this space. It includes:

| Ethereum (ETH) | Solana (SOL) | ApeCoin (APE) | Decentraland (MANA) | Axie Infinity (AXS) | The Sandbox (SAND) |

|---|

DeFi Superset

This example crypto portfolio is for those who want to invest in the decentralised finance (DeFi) sector, which is revolutionising traditional financial services. It includes:

| Ethereum (ETH) | Binance (BNB) | Uniswap (UNI) | Polygon (MATIC) | Solana (SOL) |

|---|

Top AI Tokens

This model crypto portfolio is designed for investors who are interested in the intersection of artificial intelligence (AI) and blockchain technology. It includes:

| The Graph (GRT) | Render Token (RNDR) | Injective Protocol (INJ) | SingularityNET (AGIX) | Oasis Network (ROSE) | Fetch.ai (FET) | Ocean Protocol (OCEAN) |

|---|

Conclusion

Building a diversified crypto portfolio is an essential step towards successful cryptocurrency investing. The model portfolios listed above can serve as a starting point for investors, whether they’re new to the crypto space or looking to diversify their existing holdings. Remember, it’s crucial to do your own research and consider your risk tolerance before investing in any cryptocurrency.

Ready to start building your crypto portfolio?

Consider the model portfolios above and choose the one that aligns with your investment goals and risk tolerance. Stay informed about the latest developments in the crypto space and adjust your portfolio as needed. Remember, the key to successful investing is diversification and regular portfolio review.

Risk Disclaimer

Investing in cryptocurrencies involves inherent risks, including the potential for substantial losses. The value of cryptocurrencies can be highly volatile, and there are no guarantees of profits. The model portfolios mentioned in this article are for illustrative purposes only and should not be considered as financial advice. It’s crucial to conduct thorough research, consult with a financial advisor, and assess your risk tolerance before making any investment decisions.