We are honoured to present an insightful article penned by Dr. Wajahat Mughal. By day, he is a dedicated medical doctor, healing and caring for the sick. By night, he transforms into a seasoned crypto researcher and investor. With years of experience dating back to 2019, Wajahat has carved a niche for himself in the crypto world. He hosts a popular YouTube channel where he meticulously breaks down the latest trends, tokens, and services across various digital assets. A fervent advocate for farming and staking, Wajahat consistently highlights the most lucrative opportunities for generating passive income.

His integrity and transparent approach have earned him immense respect, especially within the Muslim community. Wajahat is known for his unbiased perspectives, ensuring he neither promotes tokens without merit nor misleads his dedicated followers. His straightforward and honest investment insights have made him a trusted voice in the crypto community.

In this article, Dr Wajahat delves deep into the realm of stable coin vesting, particularly its potential impact on developing countries. We invite you to immerse yourself in his expert analysis and share your thoughts. If you appreciate content of this calibre, please let us know. We are committed to bringing you more insights from leading experts in the field.

Inflation?

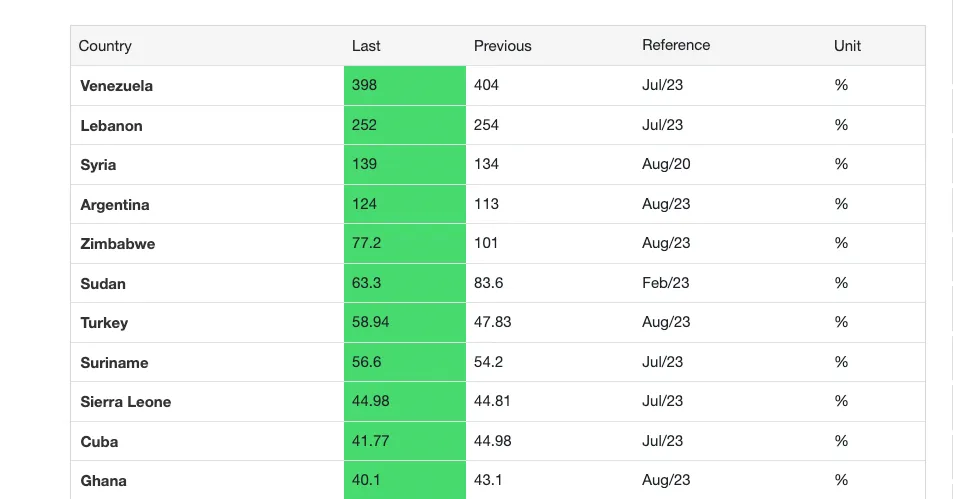

What do Venezuela, Lebanon, Syria, Argentina, Zimbabwe, Sudan, Turkey, Cuba, Ghana, Iran, Egypt, Ethiopia, Congo, Pakistan and Nigeria have in common?

These are some of the 20 plus countries currently with a 20% inflation rate. 20% actually makes some of these countries look good. The reality is the likes of some of these countries have inflation in the triple digits.

Muslims make up the majority of some of these countries and in a world where Muslims are facing oppression from all types and corners of the world, to make matters worse, the financial turmoil many of these Muslims are enduring because of inflation is a sad reality.

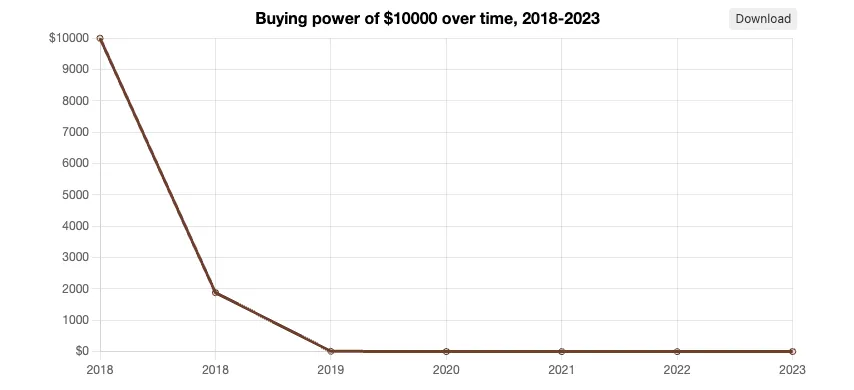

To truly comprehend this look at the chart below looking at the buying power over time in Venezuela, a country with a triple digit inflation. In just 2 years, all buying power from an initial $10,000 worth of bolívars ends up being worthless.

Looking at the population of these countries gives you an idea of how many people are plagued with this, here’s just a few of the many high inflation countries:

- Pakistan – 231 million

- Venezuela – 28 million

- Turkey – 85 million

- Syria- 21 million

- Egypt – 110 million

- Argentina – 46 million

- Zimbabwe – 16 million

- Nigeria – 213 million

This is a sad reality for likely a billion plus people in the world. The majority of which are Muslim countries.

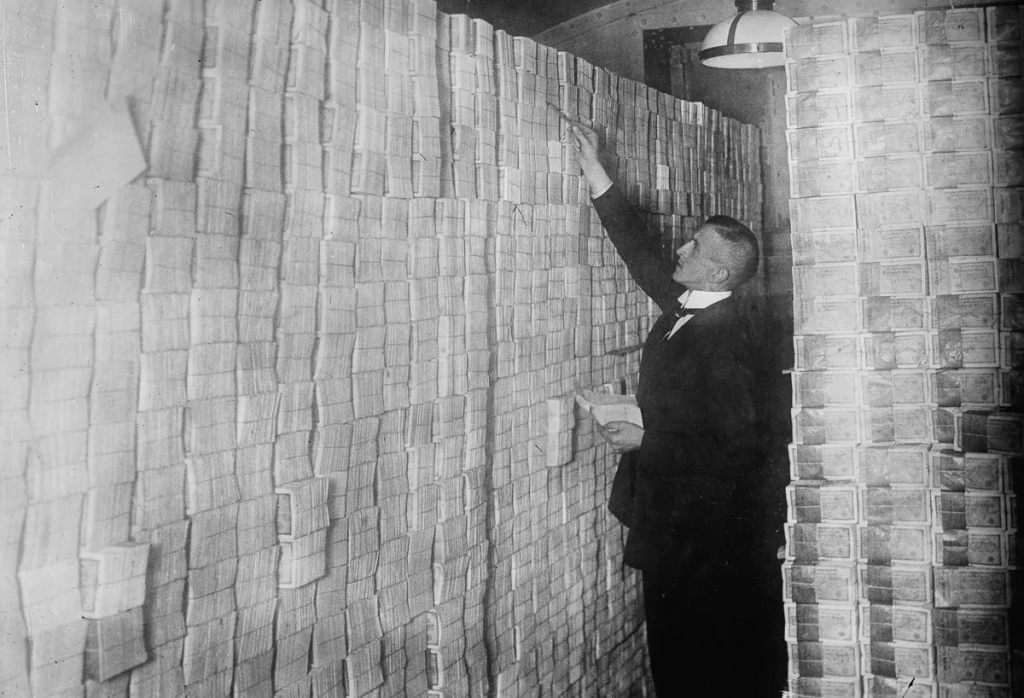

Hyperinflation is crazy!

We’ve seen it in history around 100 years ago in Germany. It doesn’t take long before currencies loose all purchasing power and cash ends up being cheaper than dirt.

Surely there is a way out for these countries?

Well, to begin with, the countries plagued with hyperinflation have ditched their own currency for the most part. It’s no surprise that US dollars are the ‘unofficial’ currencies in many of these countries and it wouldn’t surprise me if all the countries I mentioned above end up like this.

But it’s not that simple. In many of these countries, banks have banned the conversion of their native currencies to US dollars for savings. In other cases, banks have severely limited the amount that can be deposited or withdrawn monthly and therefore the people of these countries often have no choice but to live without savings and be pay-check to pay-check.

The alternative is buying dollars on the black market which as far as I am aware what many do. The black-market rate being significantly higher than the official rate meaning people are getting less for their money than they should be, but it’s at least better than holding a hyperinflation currency!

Now you must worry that you don’t get robbed, you don’t mislay the cash and where are you going to store it? Under the mattress? Cash is the only solution millions have currently.

There’s a whole other issue in everyday people getting a US Dollar or Pound Sterling account in some of these countries in the first place but I won’t touch too much on that today. Many of these billion plus people affected by inflation often work unofficial jobs being paid in cash. They don’t have invoices or proof of incomes to even think about going to a bank and opening a bank account.

So what have we found out so far?

- Countries with high inflation need an alternative stable currency or asset to enable them to preserve the purchasing power of their money

- Some use US dollars but its inaccessible, difficult to use in size and often very difficult to get custody of. You also need to go to the black market to buy physical dollars cash and then have the worry of storing it.

Thankfully, we have Crypto and Stablecoins are the solution!

In case anyone new to Crypto is reading this. Stablecoins are crypto assets usually issued on blockchains like Ethereum that are in most cases pegged to the dollar. Common examples include USDT, USDC, DAI, FRAX, LUSD, and many more.

Stablecoins solve these issues:

- Anyone can hold them, anywhere in the world, 24 hours a day and 7 days a week, in a permissionless manner and all you need it access to the internet.

- They are generally liquid and therefore easy to swap into other assets.

- A wide variety of stable backed assets are available in crypto including dollar, euro and pound backed stablecoins but even more exotic assets like gold backed stablecoins, US T-Bill and crypto asset backed stablecoins.

Now you don’t need a bank account, you don’t need documents to prove your income, you don’t need to hold cash under your mattress or get horrible rates on the black market to have some sort of stability.

P2P markets in some of these countries have made the process of buying stablecoins much easier. People can bring cash to vendors in their city or for those with banks can get these assets with on ramps. Once in the system, there is no reason to go back. Binance are one of the leading companies in the world to offer such services.

Companies like Tether and Circle hold dollars, often in the form of short term treasuries and then issue their asset against it. Therefore, $1 USD = $1 USDC. These are centralised stable coins as they are issued by centralised companies.

Other stablecoins like LUSD are issued by users minting this against assets like $ETH which is used as a collateral. This is an example of a decentralised stablecoin because it is issued by smart contracts that are immutable. There are a wide range of decentralised stable coins to choose from, many having different and unique mechanics related to how they are issued, how they remain stable and how they can be used in the wider crypto space. Many of which avoid things such as ‘interest’ which we often see with traditional investments.

Now the billions in the world struggling with their own economies can have exposure to one of the strongest currencies in the world. They can keep that purchasing power they would otherwise loose. One thing I haven’t mentioned is the real power that these stablecoins gives users is not just the idea that people in less economically developed countries can use them as a hedge but the idea that these stablecoins can be used in a wide range of financial products that have been built for permissionless use on blockchains like Ethereum.

It means that these people can access services like investing, savings accounts, money markets, dividend and passive income strategies, yield generation, real world assets on chain, insurance, infrastructure, liquid staking and so much more. The opportunities are expanding every single week as more of these financial protocols are built on these blockchains.

We call this DeFi?

DeFi offers the globe an equal opportunity to participate in finance and make better lives for themselves. The 32 year old Pakistani man working day in day out as a Taxi driver earning only $100 a month can finally begin his savings account for his children’s university fund using stablecoins on chain. He no longer has to let his Rupee devalue beyond imagination and can start to build wealth rather than loose with now that we have stable coins.