Uniswap is a decentralised exchange (DEX) that operates on the Ethereum blockchain. It allows users anywhere in the world to trade crypto without the need for a centralised authority. Uniswap is also a cryptocurrency with its own governance token, UNI. It’s an open-source project and falls into the category of a DeFi product because it uses smart contracts to facilitate trades.

How does Uniswap work?

Uniswap uses a set of smart contracts to execute trades on its exchange. These smart contracts hold liquidity pools of various crypto tokens. When a user wants to make a trade, they interact with the smart contract, which automatically executes the trade based on the liquidity available in the pool. The price of tokens is determined algorithmically based on the ratio of the two tokens in the pool.

Uniswap vs Traditional Exchanges

Unlike most exchanges, which are designed to take fees, Uniswap is designed to function as a public good—a tool for the community to trade tokens without platform fees or middlemen. This is a significant departure from traditional centralized exchanges, which act as intermediaries and charge fees for their services.

Benefits of Using Uniswap

One of the main benefits of Uniswap is that it allows users to trade directly from their wallets, providing a higher level of security. There’s no need to deposit funds into an exchange and risk potential security breaches. Additionally, Uniswap offers the potential for high returns through liquidity provision and farming UNI tokens.

Risks and Downsides

As with all DeFi platforms, there are risks involved in using Uniswap. These include smart contract bugs and the potential for significant price slippage on larger trades. It’s essential to do your own research and understand these risks before using Uniswap or any other DeFi platform.

How to Use Uniswap

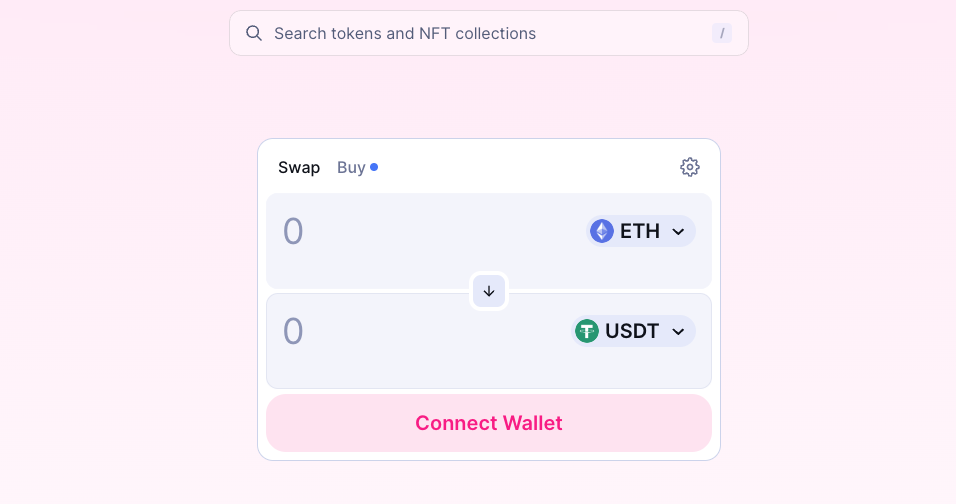

Using Uniswap involves connecting a wallet, selecting the tokens you want to trade, and executing the trade. You can also provide liquidity to a pool and earn fees from trades. Additionally, UNI token holders can participate in the platform’s governance, voting on proposals that shape the future of Uniswap.

The Future of Uniswap

Uniswap continues to evolve, with upgrades like Uniswap V3 introducing features like concentrated liquidity and multiple fee tiers. These developments aim to make Uniswap more efficient and flexible, further solidifying its position as a leading DEX in the crypto ecosystem.

Conclusion

Uniswap has revolutionised the way we trade cryptocurrencies, offering a decentralised alternative to traditional exchanges. While it comes with its own set of risks, the potential benefits make it an exciting development in the world of DeFi. As always, remember to do your own research and understand the risks before diving in.